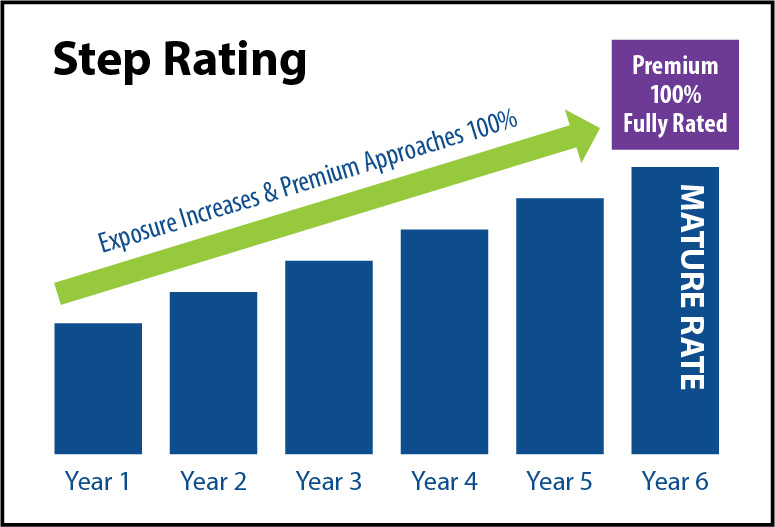

Lawyers’ professional policies are written on a claims-made basis, and claims-made policies are step rated. This means that, if an attorney has no prior acts exposure, it can be expected that for the first number of years, the policy premium will be discounted. However, that discount decreases each year until the attorney hits the full rate.

In order to fully understand the intricacies of rating, it’s essential to understand the concept of step factors used within these types of specialized policies.

What is a step factor?

Step factors within claims-made policies refer to the decrease in the step factor discount that occurs over successive policy periods. These factors are designed to account for the increasing risk associated with potential claims as time goes on. These step factors are predetermined by the insurance company, and the rationale behind these discount decreases is rooted in the fact that the likelihood of claims tends to rise with the age of the policy. Since claims-made policies operate based on when a claim is made and reported, the risk of reporting incidents from earlier periods increases over time.

For example, if an attorney has no prior acts exposure, it can be expected that for the first few years of coverage, the policy premium will be discounted. However, the discount will decrease each year until the attorney hits the full rate.

Step factors play a critical part in determining the policy’s cost, representing the increments by which premiums may increase over time. The number of years and percentage discounts vary by insurer. As a policyholder, it is crucial to understand these step factors as they directly impact the cost of coverage.

CNA’s Step Rating

The number of years and percentage discounts vary by insurer. In this case, we will only discuss the rates for CNA.

With CNA, a previously uninsured attorney with no prior acts coverage starts at Step 1 Policy Year, which is known as the retroactive date. The retroactive date is, essentially, a “starting point” for coverage, ensuring that only claims rendered on or after that specified date are covered.

In subsequent years, the retroactive date remains unchanged while the step rate increases with each year. Once the step rate hits Step 6 Policy Year, the step rate will be fully mature, and the fully mature rate will then be used.

| Step Policy Year | Percentage Discount* |

| 1 | 55% |

| 2 | 40% |

| 3 | 24% |

| 4 | 13% |

| 5 | 7% |

| 6 (and beyond) | 0% |

What Does This Mean for Your Premium?

Let’s say the mature Step 6 Policy Year rate is $2,000. You would anticipate the following premiums:

| Step Policy Year | Policy Premium |

| 1 | $900 |

| 2 | $1,200 |

| 3 | $1,520 |

| 4 | $1,740 |

| 5 | $1,860 |

| 6 (and beyond) | $2,000 |

However, step rating is not the only thing that determines your premium. There are numerous other factors that can contribute to a firm’s premium calculation including, but not limited to:

- Areas of practice

- Location

- Firm size

- Claims

- Limits of liability

- Deductible

Why Are Step Rating Discounts Available?

Attorneys experience different levels of exposure throughout the years. According to the American Bar Association, attorneys who have been practicing for less than five years report only 3.5% of malpractice claims, while attorneys who have been practicing for 11–20 years report 37% of claims.1 These statistics are likely due to the fact that less experienced attorneys have fewer matters handled and simpler legal work performed than more experienced attorneys who typically have performed more complicated legal work at larger values.

Keeping that in mind, a newly insured attorney at Step 1 Policy Year has not performed acts prior to the policy effective date that can be reported under the first policy year, which means there is a smaller chance of claims. Only claims made and reported during the first policy period for acts that were committed during this policy can be covered.

Come renewal time, the attorney will move to Step 2 Policy Year. At this step, only claims made and reported during this second policy period can be covered, but it will also include acts committed during either this policy period or the prior policy period.

At the second renewal, the attorney will move to Step 3 Policy Year. Only claims made and reported during this third policy can be covered but will include acts committed during any of these first three policy periods.

This same process continues until the attorney reaches Step 6 Policy Year, when the policy reaches maturation. A maturely rated attorney at Step 6 Policy Year can report claims made during the current policy period for acts that occurred both during the current and prior policy periods.

See the table below for an example of a claims-made policy’s step progression starting on January 1, 2024.

| Policy Year in Which Claim Was Made Against the Insured | Policy Years When Act Must Have Been Committed |

| 1/1/24 | 2024 |

| 1/1/25 | 2024–2025 |

| 1/1/26 | 2024–2026 |

| 1/1/27 | 2024–2027 |

| 1/1/28 | 2024–2028 |

Multiple Attorneys in a Firm

If you are a firm with multiple attorneys, each attorney will be rated based upon their own retroactive date and applicable step rating. The firm’s total premium will then be averaged based on the rates for each individual attorney.

For example, let’s say a firm has two attorneys—attorney A and attorney B. Attorney A has been insured for six years, and attorney B just joined the firm. Attorney B will have a retro-date and step-factor equal to the date that they joined the firm,** and their step factor will increase each year until they reach Step 6 Policy Year.

| Attorney | Step Factor |

| A | 1.00 |

| B | 0.45 |

Firm Step Factor = 0.725

The Importance of Renewal

It is of utmost importance that you continue to renew your claims-made policy. If you don’t and there is a gap in coverage, you will likely need to purchase an extended reporting period to cover your prior acts. If you later decide to buy a policy, you will be back to Step 1 with no prior acts coverage under the new policy.

Questions?

At the end of the day, Pearl Insurance is here for you. We work tirelessly to help you find a policy that fits your firm’s exact needs. Pearl takes our responsibility to protect your firm seriously and will always put people before profit.

Want to know more? Find out for yourself.

(800) 346-6680 | pearlinsurance.com/professional-liability-insurance/

These highlights are intended to present a general overview for illustrative purposes only. It is not intended to constitute a binding contract. Please remember that only the relevant insurance policy issued to a law firm can provide the actual terms, coverages, amounts, conditions, and exclusions for an insured.

*Each percentage has been rounded to the nearest whole number and is based on the premium rates filed by CNA and in effect as of September 2023.

**In some cases, underwriters will consider offering coverage to new attorneys for acts committed prior to joining the firm. If that is the case, it would change attorney B’s step factor in this example.

1“Professional Liability Insurance for Lawyers: How Does it Work?” AdvisorSmith, 2021.